Company Formation and Ongoing Tax & Accounting Oversight in Bulgaria

The establishment of companies in Bulgaria is a straightforward process, attracting many investors due to the country’s low corporate tax rate of 10%, one of the lowest in the EU. Bulgaria offers a favorable business environment with simple registration procedures and relatively low operational costs. However, tax and accounting monitoring are crucial to ensure compliance with local regulations. Businesses must adhere to strict accounting standards, submit regular financial reports, and meet tax obligations, including VAT and corporate income tax filings. Professional accounting services are often recommended to navigate the regulatory framework effectively and avoid potential penalties.

Strategic Advisory on Company Setup, Financial Compliance, and Access to Investment Opportunities in Norway (Fund raising)

Establishing a company in Norway requires compliance with local regulations, including business registration, tax obligations, and accounting standards. Norway has a corporate tax rate of 22% and a well-regulated business environment that ensures transparency and efficiency. Companies must register with the Brønnøysund Register Centre and comply with VAT and payroll tax requirements if applicable. Proper tax and accounting monitoring are essential to meet financial reporting deadlines and avoid penalties. Professional advisory services can help businesses navigate the complexities of Norwegian tax laws, ensure accurate bookkeeping, and maintain compliance with all legal requirements.

Funding an export Project in Norway

Funding an export project in Norway can be achieved through various financial instruments and government support programs. Businesses looking to expand internationally can apply for grants, loans, and guarantees from institutions like Innovation Norway, which provides funding X3 the budget for export-related activities such as market research, product development, and international marketing. Additionally, companies can seek private investment or bank financing to budget for their export operations, ensuring sustainable growth and market expansion. Proper financial planning and strategic resource allocation are essential to budget effectively for an export project and maximize success in global markets.

Strategic Business Plan Drafting for Inclusion in Government Development Incentive Programs

Strategic Business Planning to Support Funding Applications under the Greek Recovery and Resilience Mechanism.

Project financing from funds.

business plan development and consulting until disbursement

Ιntegrated Study for the Development and Execution of Renewable Energy Source (RES) Projects

Photovoltaics

NGCCP (Natural Gas Combined Cycle Power Plants)

NGCCP is a profitable business opportunity in the field of Energy projects and Natural Gas Cogeneration and more particularly the installation of High Efficiency Natural Gas Electricity and Heat Cogeneration Plants (NGCCP) in hydroponic greenhouses. The scope of such an undertaking is to produce electricity to be sold to the Electricity Distribution Network Operator (HEDNO) and to make use of the heat produced to operate a Hydroponic Greenhouse with zero energy costs.

Funding and Refinancing

Securing proper funding and refinancing solutions is essential for business growth and stability. Whether through bank loans, private investors, or alternative financing methods, obtaining capital at the right terms can significantly impact a company's operations and expansion. Refinancing existing debt can also optimize financial structures, reduce interest costs, and improve cash flow, ensuring long-term sustainability.

Sales training

Effective sales training empowers teams with the skills and strategies needed to drive revenue and customer engagement. By focusing on communication, negotiation, and relationship-building techniques, businesses can improve conversion rates and foster client loyalty. Customized training programs tailored to specific industries enhance performance and help sales professionals adapt to market changes, leading to consistent business growth.

Debt Negotiations and settlement

Negotiating debt with banks is a critical step for companies seeking financial relief or better repayment terms. Through professional negotiation, businesses can secure lower interest rates, extended payment periods, or even partial debt forgiveness. Establishing a clear financial strategy and demonstrating repayment capability can strengthen a company's position, ensuring mutually beneficial agreements that safeguard business continuity.

Accounts Opening Abroad

Opening bank accounts abroad offers companies access to international markets, diversified financial services, and enhanced operational flexibility. This process requires careful planning to comply with local regulations and banking requirements. Establishing foreign accounts facilitates global transactions, currency diversification, and better financial management, giving businesses a competitive edge in international trade.

Evaluation and selling strategy

Accurate business evaluation is crucial when preparing for a sale, merger, or acquisition. A thorough assessment of financial statements, market positioning, and growth potential determines a company's true value. Strategic planning and professional guidance help owners maximize their returns while ensuring a smooth transition. Selling a business at the right time and under optimal conditions can lead to significant financial gains and new opportunities.

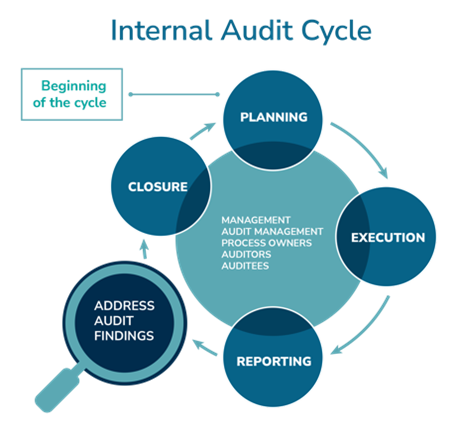

Internal Audit

Internal audit services help businesses assess and improve their risk management, control processes, and operational efficiency. By identifying weaknesses and ensuring compliance with industry regulations, internal audits enhance transparency and protect against financial and operational risks. A well-structured audit system strengthens corporate governance and fosters long-term business success.

Accounting and Tax Services

Comprehensive accounting and tax services ensure accurate financial reporting and regulatory compliance. From bookkeeping to tax filings, businesses benefit from expert guidance that optimizes financial performance and minimizes tax liabilities. Proper accounting practices support informed decision-making, enabling companies to focus on growth and profitability.

Financial Statement Audit

A thorough financial statement audit provides stakeholders with confidence in a company’s financial health and integrity. Independent audits assess the accuracy of financial records, compliance with accounting standards, and overall transparency. Reliable financial reporting enhances credibility, facilitates investment opportunities, and ensures regulatory adherence.

Certified Public Accountant (CPA – Class A)

A Certified Public Accountant (Class A) offers high-level expertise in financial management, tax planning, and corporate compliance. Their extensive knowledge ensures businesses maintain financial accuracy, meet legal obligations, and implement strategic tax-saving solutions. Engaging a qualified CPA strengthens financial decision-making and long-term sustainability.

Audit Services

Professional audit services help businesses maintain financial accuracy, compliance, and operational efficiency. Whether conducting statutory audits, forensic audits, or internal control evaluations, auditors provide valuable insights that improve financial stability. Regular audits reinforce trust among stakeholders and enhance corporate accountability.

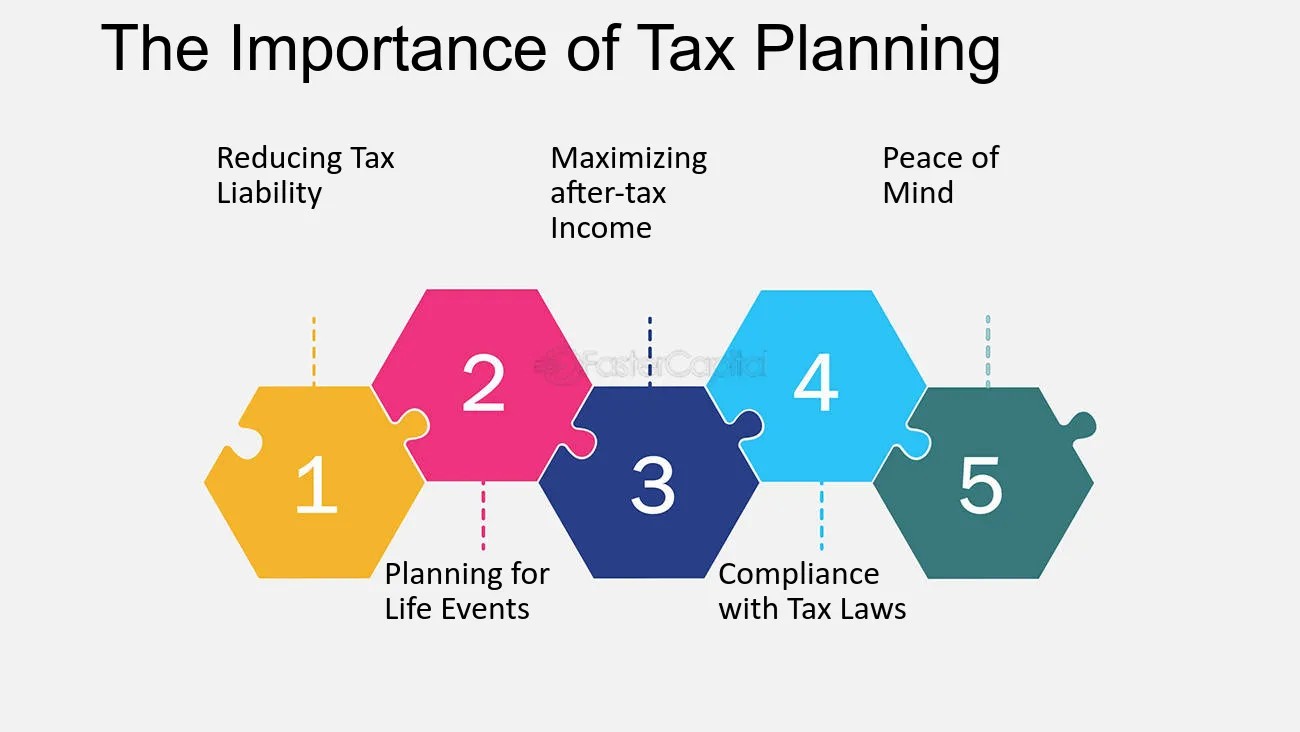

Tax Planning

Effective tax planning strategies minimize tax liabilities while ensuring compliance with national and international regulations. Businesses can optimize their tax structures, leverage incentives, and avoid unnecessary costs through strategic financial planning. Proactive tax management improves profitability and aligns with long-term corporate goals.

Mergers and Acquisitions

Mergers and acquisitions (M&A) facilitate business expansion, market penetration, and operational synergies. A successful M&A process requires thorough due diligence, valuation assessments, and strategic negotiations. Professional guidance ensures seamless transactions, maximizing value for stakeholders while mitigating risks.

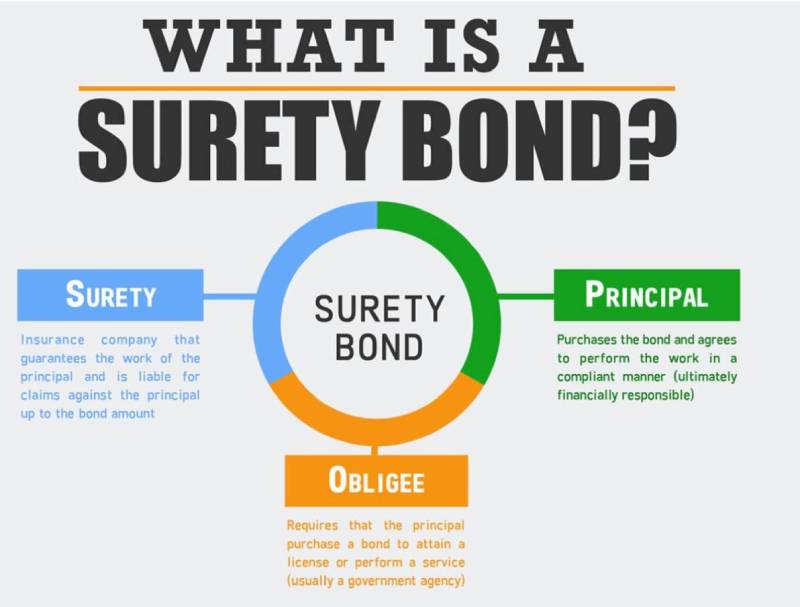

Comprehensive Issuance Services for All Categories of Surety Bonds

Surety bonds (Εγγυητικές Επιστολές) are a standard financial instrument in Greece, issued primarily by banks or insurance companies to guarantee the fulfillment of contractual or financial obligations. Widely used in public procurement, construction, real estate, and international trade, these bonds provide assurance to beneficiaries—such as public authorities or private entities—that the obligations of the principal will be met. Common types include bid bonds, performance bonds, and advance payment guarantees, all governed by Greek banking legislation and European financial regulations to ensure transparency and financial security.

Bid bonds (“Εγγυητικές Επιστολές Συμμετοχής”) are required in procurement procedures to confirm that a bidder will honor the terms of their offer if awarded the contract. Performance bonds (“Εγγυητικές Επιστολές Καλής Εκτέλεσης”) and maintenance bonds (“Εγγυητικές Επιστολές Καλής Λειτουργίας”) are commonly used in construction and infrastructure projects to secure proper execution and long-term operation. These instruments are essential for managing contractual risk, offering financial protection in the event of non-performance or defects, and are tightly regulated under Greek and EU frameworks.

Professional Website & E-Commerce Development Services

We offer high-quality, custom website and e-commerce development services tailored to meet your business goals. Whether you're launching a new brand or looking to upgrade your online presence, we design and build responsive, user-friendly websites and fully functional online stores that enhance customer engagement and drive sales. From concept to launch, we combine modern design with the latest technologies to deliver a seamless digital experience that sets you apart from the competition.