Smart solutions. Strategic impact.

At AMG II, we provide integrated consulting, financial, and digital services tailored to your business goals. Whether you’re launching, scaling, or restructuring, our team is here to help you make confident, data-backed decisions.

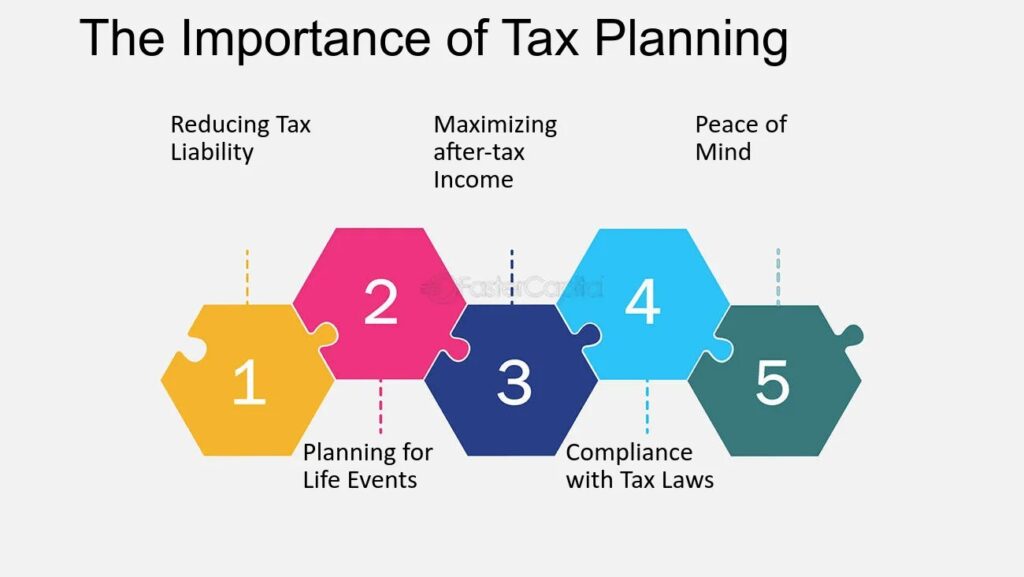

The establishment of companies in Bulgaria is a straightforward process, attracting many investors due to the country’s low corporate tax rate of 10%, one of the lowest in the EU. Bulgaria offers a favorable business environment with simple registration procedures and relatively low operational costs. However, tax and accounting monitoring are crucial to ensure compliance with local regulations. Businesses must adhere to strict accounting standards, submit regular financial reports, and meet tax obligations, including VAT and corporate income tax filings. Professional accounting services are often recommended to navigate the regulatory framework effectively and avoid potential penalties.

Establishing a company in Norway requires compliance with local regulations, including business registration, tax obligations, and accounting standards. Norway has a corporate tax rate of 22% and a well-regulated business environment that ensures transparency and efficiency. Companies must register with the Brønnøysund Register Centre and comply with VAT and payroll tax requirements if applicable. Proper tax and accounting monitoring are essential to meet financial reporting deadlines and avoid penalties. Professional advisory services can help businesses navigate the complexities of Norwegian tax laws, ensure accurate bookkeeping, and maintain compliance with all legal requirements.

Funding an export project in Norway can be achieved through various financial instruments and government support programs. Businesses looking to expand internationally can apply for grants, loans, and guarantees from institutions like Innovation Norway, which provides funding X3 the budget for export-related activities such as market research, product development, and international marketing. Additionally, companies can seek private investment or bank financing to budget for their export operations, ensuring sustainable growth and market expansion. Proper financial planning and strategic resource allocation are essential to budget effectively for an export project and maximize success in global markets.

Our service focuses on the development of robust, forward-thinking strategic business plans designed specifically for eligibility and success in national and EU-funded development incentive programs. We provide end-to-end support for companies aiming to leverage public funding to scale operations, innovate, and enhance competitiveness.

This includes market analysis, detailed financial projections, impact assessments, and alignment with governmental priorities such as digital transformation, sustainability, regional development, and job creation. Each business plan is tailored to meet the strict evaluative criteria of funding bodies, combining traditional business discipline with modern innovation strategies.

Our objective is to transform a good idea into a fully fundable, growth-oriented venture with a clear implementation roadmap and measurable outcomes, maximizing the likelihood of approval and long-term success.

NGCCP is a profitable business opportunity in the field of Energy projects and Natural Gas Cogeneration and more particularly the installation of High Efficiency Natural Gas Electricity and Heat Cogeneration Plants (NGCCP) in hydroponic greenhouses. The scope of such an undertaking is to produce electricity to be sold to the Electricity Distribution Network Operator (HEDNO) and to make use of the heat produced to operate a Hydroponic Greenhouse with zero energy costs.

Business Consulting & Financial Services

📍 Sofia, James Borchier 103 , Lozenets

📞 +306944001441

✉️ info@amgii.eu

© 2009–2025 AMG ΙΙ. All rights reserved | Powered by ARGONSTACK